An article was published on January 18, 2024 from the EIA (Energy Information Administration) titled “In most U.S. regions, 2024 wholesale electricity prices will be similar to 2023.”

The EIA has selected several major hubs in the United States and researched the wholesale cost of electricity in 2023. This is interesting in that the 2023 electricity prices had climbed dramatically compared to the years prior, as generation fuel costs and demand have skyrocketed.

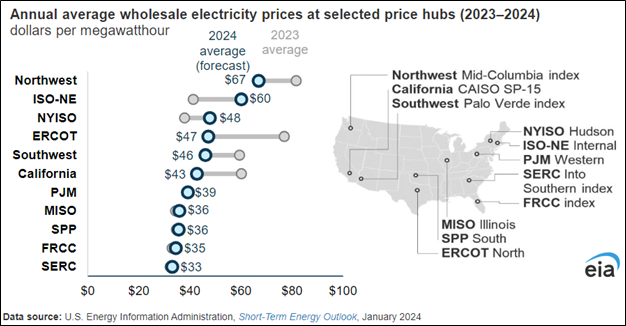

As shown Figure 1, the EIA forecasts that electricity prices, especially those operating outside the Northeast, will remain about the same at $30 to $40/MWh (per megawatt-hour). The Eastern interconnection generally has the highest wholesale prices in the country. New York is expected to receive $48/MWh and New England is expected to receive $60/MWh.

Figure 1

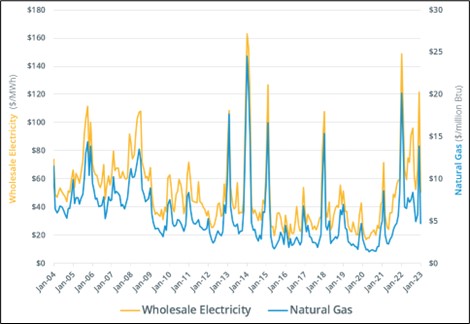

Electricity prices are largely affected by natural gas prices as it is often the highest-cost firing technology dispatched for power generation. Natural gas-fired generation is the largest source of electricity in the United States. Figure 2 shows the correlation between natural gas prices and wholesale electricity prices.

Figure 2

In the 2024 January Energy Outlook, natural gas prices are expected to average $2.91 per million British thermal units (MMBtu). In 2023, the Pacific Northwest had gas prices jump to $6.96/MMBtu and consequently, wholesale electricity prices rose to $67/MWh.

What does this mean for valuation experts like us?

Power plants and other utilities are usually valued via an income approach, as they are income-producing assets. As appraisers, we analyze the historical revenues and expenses and forecast the upcoming cash flows. Due to the rise in electricity prices in recent years, values of power plants are expected to rise as well.

Do you have a question as to whether or not your power plant or energy-related asset has increased in value due to the rising costs of electricity? Consult us today at 908-534-3590!

Download This Article as PDF

To get this Article as PDF fill out this form and click on Download as PDF.